Angry Public is Blaming Business, Government, and Organized Labor for the Weak Economy

Strained States Turning to Laws to Curb Labor Unions

The New York TimesJanuary 3, 2011

Faced with growing budget deficits and restive taxpayers, elected officials from Maine to Alabama, Ohio to Arizona, are pushing new legislation to limit the power of labor unions, particularly those representing government workers, in collective bargaining and politics.

But in some cases — mostly in states with Republican governors and Republican statehouse majorities — officials are seeking more far-reaching, structural changes that would weaken the bargaining power and political influence of unions, including private sector ones.

For example, Republican lawmakers in Indiana, Maine, Missouri and seven other states plan to introduce legislation that would bar private sector unions from forcing workers they represent to pay dues or fees, reducing the flow of funds into union treasuries. In Ohio, the new Republican governor, following the precedent of many other states, wants to ban strikes by public school teachers.

Some new governors, most notably Scott Walker of Wisconsin, are even threatening to take away government workers’ right to form unions and bargain contracts.

“We can no longer live in a society where the public employees are the haves and taxpayers who foot the bills are the have-nots,” Mr. Walker, a Republican, said in a speech. “The bottom line is that we are going to look at every legal means we have to try to put that balance more on the side of taxpayers.”

Many of the proposals may never become law. But those that do are likely to reduce union influence in election campaigns, with reverberations for both parties.

In the 2010 elections, Republicans emerged with seven more governor’s mansions and won control of the legislature in 26 states, up from 14. That swing has put unions more on the defensive than they have been in decades.

But it is not only Republicans who are seeking to rein in unions. In addition to Mr. Cuomo, California’s new Democratic governor, Jerry Brown, is promising to review the benefits received by government workers in his state, which faces a more than $20 billion budget shortfall over the next 18 months.

“We will also have to look at our system of pensions and how to ensure that they are transparent and actuarially sound and fair — fair to the workers and fair to the taxpayers,” Mr. Brown said in his inaugural speech on Monday.

Many of the state officials pushing for union-related changes say they want to restore some balance, arguing that unions have become too powerful, skewing political campaigns with their large war chests and throwing state budgets off kilter with their expensive pension plans.

But labor leaders view these efforts as political retaliation by Republicans upset that unions recently spent more than $200 million to defeat Republican candidates.

“I see this as payback for the role we played in the 2010 elections,” said Gerald W. McEntee, president of the American Federation of State, County and Municipal Employees, the main union of state employees.Mr. McEntee said in October that his union was spending more than $90 million on the campaign, largely to help Democrats.

“Now there’s a bull’s-eye on our back, and they’re out to inflict pain,” he said.

In an internal memorandum, the A.F.L.-C.I.O. warned that in 16 states, Republican lawmakers would seek to starve public sector unions of money by requiring each government worker to “opt in” before that person’s dues money could be used for political activities.

“In the long run, if these measures deprive unions of resources, it will cut them off at their knees. They’ll melt away,” said Charles E. Wilson, a law professor at Ohio State University.

Of all the new governors, John Kasich, Republican of Ohio, appears to be planning the most comprehensive assault against unions. He is proposing to take away the right of 14,000 state-financed child care and home care workers to unionize. He also wants to ban strikes by teachers, much the way some states bar strikes by the police and firefighters.

“If they want to strike, they should be fired,” Mr. Kasich said in a speech. “They’ve got good jobs, they’ve got high pay, they get good benefits, a great retirement. What are they striking for?”Mr. Kasich also wants to eliminate a requirement that the state pay union-scale wages to construction workers on public contracts, even if the contractors are nonunion. In addition, he would like to ban the use of binding arbitration to settle disputes between the state and unions representing government employees.

Labor leaders, who argue that government employees are not overpaid, worry that many of these measures have a much better chance of enactment than in previous years because of Republican electoral gains and recession-ravaged taxpayers’ reduced sympathy toward government workers.

The A.F.L.-C.I.O.’s internal memo warned labor leaders,

“With the enormous losses in state legislatures around the country, we will face not only more attacks on working families and their unions — we will face more serious attacks, particularly in the formerly blue or purple states that are now controlled by a Republican trifecta.”

It pointed in particular to six states, including several former union strongholds, where Republicans control the governor’s mansion and both houses of the legislature: Indiana, Maine, Michigan, Ohio, Pennsylvania and Wisconsin.

Naomi Walker, the A.F.L.-C.I.O.’s director of state government relations, said many voters would oppose the antiunion efforts.

“I think folks in these states are going to ask whether this is the right time to weaken unions when corporations are amassing more power than ever,” she said. “We’ve been fighting against privatizing Social Security and sending jobs offshore and to get the best deal for the unemployed. It would be a lot easier for Republicans if unions weren’t there to throw up these roadblocks.”

Union leaders particularly dread the spread of right-to-work laws, which prevail in 22 states, almost all in the South or West. Under such laws, unions and employers cannot require workers to join a union or pay any dues or fees to unions to represent them.

Unions complain that such laws allow workers in unionized workplaces to reap the benefits of collective bargaining without paying for it. Pointing to lower wages in right-to-work states, unions say the laws lead to worse wages and benefits by weakening unions.

But lawmakers who are pushing right-to-work laws argue that they help attract investment.

“The folks who work day-to-day in economic development tell us that the No. 1 thing we can do to make Indiana more attractive to business is to make Indiana a right-to-work state,” said Jerry Torr, an Indiana state representative who backs such legislation.

Some union leaders say that proposals like right-to-work laws, which have little effect on state budgets, show that Republicans are using budget woes as a pretext to undercut unions.

“They’re throwing the kitchen sink at us,” said Randi Weingarten, president of the American Federation of Teachers. “We’re seeing people use the budget crisis to make every attempt to roll back workers’ voices and any ability of workers to join collectively in any way whatsoever.”

A group composed of Republican state lawmakers and corporate executives, the American Legislative Exchange Council, is quietly spreading these proposals from state to state, sending e-mails about the latest efforts as well as suggested legislative language.

Michael Hough, director of the council’s commerce task force, said the aim of these measures was not political, but to reduce labor’s swollen power.

“Government budgets have grown and grown because of the cost of employees’ pensions and salaries,” he said. “Now we have to deal with that.”

In Union Strongholds, Residents Wrestle with Cuts

The Associated PressMarch 5, 2011

There once was a time when Harry and Nancy Harrington — their teenage children in tow — walked the picket line outside the nursing home where she was a medical aide, protesting the lack of a pension plan for the unionized work force. But those days of family solidarity are gone.

Harry now blames years of union demands for an exodus of manufacturing jobs from this blue-collar city on the shore of Lake Michigan. He praises new Wisconsin Gov. Scott Walker for attempting to strip public employee unions of nearly all of their collective bargaining rights. Protesters opposed to Walker's plan have held steady at the Wisconsin Capitol for nearly three weeks, though their overnight sit-ins ended Thursday with a judge's order.

"I'm sorry, but the unions want to yell, they want to intimidate," says Harry Harrington, 69, as he sets a coffee cup down next to another newspaper headline about the union demonstrations.The Harringtons typify the new national reality for labor unions. Support is no longer a sure thing from the middle class — not even in a city long considered a union stronghold in a state that gave birth to the nation's largest public employee union.

"They want to be heard," retorts Nancy Harrington, 66, who fears a weakened union would jeopardize the teaching career of their now 38-year-old daughter.

National polls show that the portion of the public that views unions favorably has dropped to near historic lows in recent years, dipping below 50 percent by some accounts.

But surveys also show a public uneasy with attempts to weaken union bargaining rights by emboldened Republican governors who swept into power in the 2010 elections amid concerns about state finances. A Pew Research Center poll released earlier this week found more adults nationwide sided with unions than the governor in the Wisconsin dispute.

For unions, the political standoffs occurring in states such as Wisconsin, Indiana and Ohio and are a make or break moment — a chance to repair tarnished luster or risk sinking toward irrelevancy among the American public.

In Racine, a nearly two-hour drive southeast of the epicenter of the union controversy in Madison, the question of the union's appropriate role has divided husband and wife, mother and child, co-workers and friends. It's the hot topic on editorial pages, at coffee shops, even at the craft club that meets in the community center at Roosevelt Park, where a dozen retired women recently were talking over the top of each other about union powers while knitting socks and hats.

Among these women, at least, the pro-union protesters are right and Wisconsin's governor is wrong. Their group includes a retired Racine public school teacher who in 1977 joined in a teacher walkout that lasted more than a month. Racine schools shut down again for one day this February when a quarter of their teachers were absent in a show of support for pro-union protesters.

Yet the teachers' union is not the power it once was in the Racine area. Despite a well-funded media campaign, the union's candidate, Democratic state Sen. John Lehmen, of Racine — a former high school teacher — was ousted by Republican challenger Van Wanggaard in last fall's election. District voters also picked Walker over Democratic gubernatorial candidate Tom Barrett.

When the teachers walked out last month in nearby Kenosha, substitutes such as Kevin Kreckling quickly stepped forward.

"I felt a little torn — I wanted to have solidarity with the teachers, but I have to make money, too," said Kreckling, 30, the son of a union painter and who is studying to be a teacher at Concordia University in Mequon.The decline in union power is perhaps best symbolized by the area near Roosevelt Park, where a monument dedicated by the AFL-CIO honors the Depression-era president who signed a 1935 federal law guaranteeing collective bargaining rights. Not far away is a tall chain link fence protecting the vacant plot of the old Case Corp. farm equipment factory, which was razed a few years ago after the company merged with another corporation and then downsized.

CNH Global N.V., the successor company, still operates in the area. And the city remains the home of S.C. Johnson & Son Inc., which makes cleaning products and bug sprays, and vehicle radiator maker Modine Manufacturing Co. Yet numerous other companies have scaled back or shut down, resulting in the loss of a third of Racine's manufacturing jobs in the past 20 years, according to federal Bureau of Labor Service statistics.

"It's been a real blood-letting of companies," said Racine Mayor John Dickert, adding optimistically: "But we're turning that around."Racine's unemployment rate remains the second highest in the state, at 12.8 percent in December. As the jobs have diminished, so also have the union ranks. But the problem isn't solely about fewer members. It's also that more people have come to perceive union employees as the beneficiaries of cushy pension and health care plans that others no longer enjoy, and even attribute union gains to business losses.

"Way back when, they protected the workers when there was no protection — when they were overworked and not paid enough. But in today's society, they're too strong," said Wendy Vesely, a Modine employee who was celebrating her 44th birthday with her family at Racine diner that attracts a cross-section of pro- and anti-union patrons.Vesely thinks the Wisconsin governor is on the right track, but may be "trying to get too much too quickly."

Barbara Ford, one of the knitters at the community center, said she thought little about unions when she worked in the finance department at S.C. Johnson, a non-union company. Now, with Walker's push to limit their bargaining rights,

"Every time I think about it, my blood boils," said Ford, 65, who retired five years ago. "It's just horrible what he's doing to the state."Public anxiety about the economy has created an opportunity for pro-business Republican officials to challenge unions in ways that would have been unthinkable even a few years ago.

In Missouri, where unions' share of the work force is half what it was a generation ago, the leader of the state Senate is pushing for "right to work" legislation that would prohibit union shops in which all workers must pay union fees. In Ohio, Republican leaders are pushing a bill that would restrict collective bargaining rights for 350,000 public employees.

The national framework for collective bargaining was laid in 1934 in Toledo, Ohio, after a violent labor dispute. But there's no question that support for unions has waned there in recent years, said Oscar Bunch, 81, who worked for 50 years at a General Motors plant. He notices a mindset now that anyone with a well-paying job is lucky.

Auto workers have given "concession after concession," and that hasn't helped the cause of public-sector employees, he said.Dining at the same restaurant as Bunch, union electrician Norman Cook, 57, of Elmore, Ohio, said the Republican officials sense an opportunity.

"Their entire motive is to bust unions," he said. "They're taking advantage of the financial times."Just south of Racine, in what would have been the shadow of the former Case foundry, Jim Geshay runs a one-man chemical repackaging business in an aging cinder block building across the street from the bar that has been a union hang out. Yet Geshay says he soured on unions during the 1977 teachers strike when teachers he trusted tried to stop students from attending classes.

"I personally think it's time for them to pay their fair share," Geshay said.

Ohio, Wisconsin Shine Spotlight on New Union Battle: Government Workers vs. Taxpayers

Fewer than 7 percent of private workers are unionized, down from about 25 percent in the 1970sThe Washington Post

February 28, 2011

Across Ohio last week, the legislative push to restrict the union rights of government workers was greeted again and again by noisy protests.

But in this state dotted with manufacturing plants and their locals, this may have been more striking: At least some elected officials normally sympathetic to industrial unions were questioning whether they should side with government workers.

"I believe in what unions do, but as an elected official I represent the taxpayers," said Jeff Berding, a registered Democrat on the Cincinnati City Council who ran as an independent after he opposed the party on a union issue. "I'm trying to get the best deal for them."The divide between government worker unions and their opponents, playing out now in several state capitals, highlights a critical aspect of the evolving labor movement.

Throughout U.S. history, the most prominent union clashes largely involved employees squaring off against big corporate owners over how to share profits. The recent state budget controversies feature union members bargaining against state and local governments over wages and benefits provided by taxpayers.

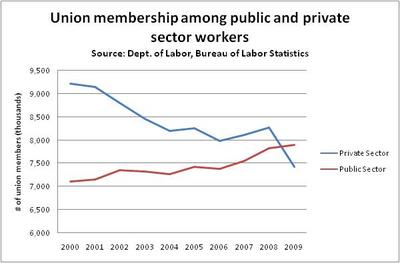

The shift reflects the profound changes in American unionism. Last year, for the first time in American history, a majority of union members worked for the government rather than private firms. About 36 percent of government workers, or 7.6 million people, are members of unions, compared with about 7 percent of private-sector workers, or 7.1 million people, according to the Bureau of Labor Statistics.

And with that evolution comes different tactics and politics.

"These people are bargaining against the American taxpayer," said Ned Ryun, a former speechwriter for George W. Bush and the president of American Majority, a grass-roots political training organization that also has helped coordinate anti-tax rallies. "I'm not sure they can win the PR battle. People are saying, 'You're kidding me. They're making that much and I'm paying for it?' "Randi Weingarten, president of the American Federation of Teachers, was in Columbus this week for protests. She said in an interview that the argument that public unions are fighting the taxpayer is misguided.

"You have long-standing history in Ohio of using collective bargaining to do transformative things in education," she said.Public vs. private

While government unions and their private-sector counterparts are lumped together under the labor movement umbrella, they are in some ways starkly different, emerging according to different laws and bargaining under different constraints.

While the National Labor Relations Act, passed in 1935, allowed employees to form unions and collectively bargain in much of the private sector, it was not immediately clear to what extent government workers should be protected by unions.

Why Is the Public Suddenly Down on Unions?

The Bad Economy’s to Blame—Support Should Recover When the Economy DoesBy David Madland, Karla Walter, Center for American Progress Action Fund

July 20, 2010

Download this memo (pdf)

Additional references for this memo are contained in the PDF.

Americans have expressed generally positive attitudes toward unions for as long as pollsters have been asking, and for decades public approval of labor unions has hovered around 60 percent. But starting in 2009 public opinion toward labor unions dropped precipitously. Why?

Last summer less than half of Americans said they approved of labor unions. This is the first time this happened in the over 70 years the Gallup survey research group has asked. Just one year earlier nearly 60 percent of respondents approved of labor unions. Similarly, a 2010 Pew Center for the People and the Press survey found union favorability was at just 41 percent, while in 2007—the last time they asked the question—favorability was 58 percent. The Pew survey also found that the decline in support was widespread, falling for virtually every demographic and political group.

What happened? And what does this mean for the U.S. labor movement’s future given that membership is already at 30-year lows?

The answer is largely that the public is angry about the weak economy and is blaming major economic institutions such as business, government, and organized labor. As a result, support for unions should improve when the economy gets back on track. Moreover, despite the drop in overall approval the public continues to value many of the functions unions perform—such as helping workers.

Still, labor unions may have suffered a more lasting blow. It’s hard to know the longer-term effect of the government’s bailout of GM and Chrysler, but the bailout was deeply unpopular and may have sullied unions’ reputations. Likewise, the conservative campaign to criticize unionized public sector workers’ compensation and work ethic—although very unlikely a major source of the decline—may have some effect on the public’s opinion of unions in the future, though data limitations make it hard to know this for certain.

In short, public support for labor unions should recover when the economy improves. But unions may need to take some different actions and work on their public image to bring their approval ratings back up to pre-recession levels.

This brief will examine these issues in more detail by surveying opinion polls on unions taken over the last several decades.

The public’s recent decline in support for labor unions

The Gallup survey research group found in August 2009 that public support for labor unions had dropped significantly since its previous August 2008 survey. For the first time since Gallup began collecting information on Americans' support for labor unions less than half of Americans (48 percent) said they approved of unions. Forty-five percent said they disapproved of unions and another 7 percent had no opinion. A year earlier a strong majority (59 percent) said they approved of labor unions while 31 percent disapproved of unions and 10 percent had no opinion.

Unions enjoyed approval ratings for decades that hovered around 60 percent. Previous low points occurred in 1979 and 1981—also years of significant economic hardship—when 55 percent of respondents reported they approved of labor unions. Quite recently, in 2003, approval was at 65 percent.

Polls taken after Gallup’s have confirmed a significant decline in support for unions. The Pew Center for the People and the Press found that the percentage of Americans who had a “mostly” or “very favorable” view of labor unions fell 17 points between January 2007 and February 2010, from 58 percent to 41 percent. Forty-two percent of respondents said they had “very” or “mostly unfavorable” view of unions and another 17 percent said they had never heard of unions or refused to answer. This is the lowest rating of public support for labor unions Pew has found since it began asking the question in 1985.

Further, support for unions dropped sharply across virtually every demographic and partisan group, which indicates that the decline’s cause is likely something that has affected almost all Americans.

Our analysis of the February 2010 Pew Survey showed that support for unions fell dramatically among Americans of all races, though respondents of color continued to have more favorable views of unions than whites. Support among blacks fell 11 points between 2007 and 2010, from 80 percent to 69 percent. Among Hispanics, it fell 22 points, from 82 percent to 60 percent. And support among whites fell by 15 points, from 60 percent to 45 percent.

Favorability ratings of labor unions also fell among all age groups in Pew’s survey. But they fell slightly less so for young adults ages 18 to 29, who maintain the highest opinion of unions, and for 50- to 64-year-olds. Among the youngest generation, respondents with very or mostly favorable views of unions fell 11 points between 2007 and 2010, from 73 percent to 62 percent. Favorability ratings among those 50 to 64 remained the most stable, falling 5 points from 57 percent to 52 percent.

Support among 30- to 49-year-olds and respondents 65 and over dropped dramatically. Favorability ratings among respondents 30 to 49 years old fell 19 points between 2007 and 2010, from 64 percent to 45 percent. Among the oldest generation favorability ratings were nearly cut in half—falling 32 points—from 68 percent to 36 percent.

Unions’ favorability ratings fell 15 points between 2007 and 2010 for each educational cohort of Americans. They fell from 59 percent to 44 percent for those with a high school degree or less, 66 percent to 51 percent for respondents with some college, and 67 to 52 percent for respondents with a college degree or more.

Support similarly fell across income levels. It dropped more than 20 points for those earning less than $30,000 per year, from 75 percent to 54 percent; 9 points for those earning between $30,000 and $75,000 per year, from 63 percent to 54 percent; and 17 points for those earning $75,000 or more per year, from 56 percent to 39 percent.

It likewise dropped across the political spectrum among Republicans, Democrats, and independents. Among independents, favorable ratings dropped 17 points between 2007 and 2010, from 62 percent to 45 percent. Favorable ratings among Republicans fell by 18 points, from 51 percent to 33 percent, and among Democrats by more than 10 points, from 79 percent to 68 percent. It likewise dropped across the political spectrum among Republicans, Democrats, and independents. Among independents, favorable ratings dropped 17 points between 2007 and 2010, from 62 percent to 45 percent. Favorable ratings among Republicans fell by 18 points, from 51 percent to 33 percent, and among Democrats by more than 10 points, from 79 percent to 68 percent.

In sum, there’s clearly been a recent drop in support for unions among many Americans. Let’s take a closer look at what’s driving this decline.

Underpinnings of discontent

Americans are likely to blame the most powerful institutions in our society—government, big business, and labor unions—for economic downturns, as prominent political scientists Seymour Martin Lipset and William Schneider argued in their influential 1983 book, The Confidence Gap: Business, Labor, and Government in the Public Mind.

Lipset and Schneider showed that while Americans see our country’s economic and political institutions as the glue that holds our capitalist systems together, they do not trust the leaders of government, large corporations,

Labor unions may not have as much power as business or government, but Americans still view them as powerful, and increasingly so with the election of President Barack Obama. Sixty-six percent of Americans mostly or completely agreed with the statement “labor unions have too much power” in the April 2009 Pew Center for the People and the Press Values Survey—a 10 percentage-point increase since the question was last asked in 1999.

Since Americans now see unions as having greater control over the government’s economic policies, unions also receive greater responsibility for the country’s poor economic performance in the public’s mind.

Similarly, 44 percent of respondents to an August 2009 Gallup survey asking, “Would you, personally, like to see labor unions in the United States have more influence than they have today, the same amount as today, or less influence than they have today?” said that they would like to see labor unions have less influence than they currently do—a 10-point increase over responses just one year prior.

Despite their skepticism of power, however, the American public realizes that the competing interests of government, labor, and business create a system of checks and balances between these actors that prevents too much power from being concentrated in these institutions. Consequently, Americans approve of conflict within and among their major institutions. The institutionalized tension between labor and business is seen as checking the power of both institutions.

This support for our society’s major political and economic institutions but distrust of its leaders means that when things go wrong Americans are predisposed to turn against the institution’s leaders and assume that more honest and competent leaders could make fundamentally strong institutions work. Declining public trust in institutions is a reflection of the American public having unfulfilled needs and blaming these institutions for the unsatisfactory quality of life they are experiencing.

Opinion polling appears to bear this out by showing that American’s support rises and falls for our society’s major economic institutions depending on the economic situation.

Labor union, business, and government favorability ratings move together, and fall with a weak economy

Americans are currently very critical of the major political and economic institutions in our society as we would expect. A March 2010 Pew survey examining American’s rising dissatisfaction with the federal government finds “a perfect storm of conditions associated with distrust,” and provides a bleak picture of Americans’ views of government, labor unions, and business. Only a very small portion of respondents—between 22 percent to 32 percent—thought that these institutions had a positive effect on the way things are going in this country.

It’s no coincidence that big business, labor unions, and government are all facing the public’s ire. Unions and big corporations may sometimes find themselves at odds over labor disputes and government policy, but public support for these institutions rises and falls together over time. The same holds true for government: Government is often the arbitrator of business and labor conflicts, but public support for government is also linked to support for unions and big business.

The figure at the right displays Pew survey data from 1985-2010 on the percentage of Americans stating they had a somewhat or very favorable view of labor unions, Congress, and business corporations. It demonstrates that favorability ratings for these incumbent authorities track together. While Congress’s favorability rating is more variable—in part, because we have more data—favorable views of big business and labor unions tracked very closely together for the last quarter century.

Asked another way, Americans’ confidence in Congress, organized labor, and big business also tracks together. Nineteen percent of respondents said that they had a great deal or quite a lot of confidence in organized labor in Gallup’s 2009 survey—down 12 points from 31 percent in 2004. Confidence in big business fell 8 points between 2004 and 2009, from 24 percent to 16 percent. And though confidence in Congress rebounded from a low of 12 percent in 2008, it was still 13 points lower in 2009 (17 percent) than it was in 2004 (30 percent).

The fact that public approval of labor unions, big business, and government all fall during bad times suggests that Americans are most likely feeling cynical and expressing the conviction that the times are bad rather than rejecting labor unions, big business, or government.

The charts below describe in more detail how much the state of the economy affects support for labor unions. As we would expect, over the past 60 years, when most Americans are able to find and retain jobs, approval of labor unions is high, but when the jobs are scarce, approval of unions fall.

Regression analysis confirms this relationship, finding that for every point unemployment increases the approval rate for labor unions goes down 2.6 points.

Previous studies have confirmed this negative relationship between unemployment and union approval rates. Lipset and Schneider looked at data from the 1960s through the early 1980s and found that every 1 percent increase in unemployment tends to lower confidence in leaders of organized labor 1.3 percent.

The clear and direct impact that the economy has on support for labor unions suggests that when the economy recovers so too will unions’ approval ratings. This is further supported by evidence indicating that even in spite of the bad economy the public still believes that labor unions can play a positive role in the economy. Most Americans (61 percent), according to Pew, believe that “labor unions are necessary to protect the working person.” And a strong majority (70 percent) of Americans says that labor unions help unionized workers, according to Gallup.

But despite the overwhelming evidence pointing to the economy as the main cause of the decline, other factors may be at work. As a result, support for unions may not recover completely when the economy does.

Signs that support for organized labor may not fully recover

News coverage of the auto bailout and auto companies’ continued financial troubles captured the public’s attention from late 2008 until the middle of 2009. The public followed the December 2008 bailout closely and overwhelmingly disapproved of it.

Moreover, the bailout put unions in a precarious position. The autoworkers’ union had to protect the welfare of its members by working with GM and Chrysler to secure the bailout money. In the public’s eyes unions were collaborating with these corporations instead of acting as a “check” on the power of big business. A significant minority of the public blamed unions for the industry’s problems, and viewed unions—a powerful player in securing the assistance—as helping its own workers over taxpayers.

Americans opposed the bailout at the time of the rescue and continue to do so. Sixty percent of Americans said they disapproved of the “federal loans given to General Motors and Chrysler last year to help them avoid bankruptcy” in a March 2009 Gallup poll conducted three months after the bailout. And a May 2010 CBS News Poll found that Americans continued to oppose it over one year later: 65 percent of respondents said that the federal government should not have provided financial help to the U.S. automakers.

A significant portion of Americans appear to blame unions for the financial problems at GM and Chrysler that precipitated the assistance. More than one third of Americans said that the unions deserve “a great deal of blame” when asked in December 2008 whether the labor unions that represent many U.S. auto workers deserved a “great deal of blame, some blame, not much blame, or no blame at all for all the problems faced by the three major U.S. auto companies.” This was second only to the 65 percent who placed a great deal of blame on the company’s corporate executives.

Moreover, it appears that overall views of the auto industry are closely linked with attitudes toward labor unions—likely in part because of the bailout. Americans with unfavorable views of American automakers are significantly more likely to also have unfavorable views of labor unions. Sixty-six percent of respondents with very unfavorable views of U.S. automakers and 61 percent of respondents with mostly unfavorable views of U.S. automakers also had unfavorable views of unions, according to a February 2010 Pew survey. Only one-third of those with very favorable and less than half of those with mostly favorable views of American automakers have unfavorable views of labor unions.

So the bailout has likely had some effect on the public’s view of unions, though at this point it is hard to tell what the lasting impact will be. The debate over whether and how much to blame government employees—many of whom are unionized—for the budget deficits that many governments now face also could potentially affect union support in the future, though there is little evidence that it has done so to date.

Data limitations make it difficult to know for certain, but it is unlikely that concerns about public employee unions are a major reason for the recent drop in support for unions in general— most Americans support public sector unions despite the poor state of the economy. An April 2010 Rasmussen survey finds that 59 percent of adults favor unions for public employees, while 41 percent are opposed to them. Slightly more than half of Americans (51 percent) believe that public employee unions do not put a significant strain the U.S. budget, while 49 percent believe that unions do so.

On a related note, Americans’ confidence in federal government workers—regardless of union status—is more positive than negative but still quite mixed. And these views largely held fairly steady between 2009 and 2010, with some minor declines in confidence according to a George Washington University survey. Americans expressing a great deal or a lot of confidence in “civilian employees of the federal government” fell 2 points, from 23 to 21 percent, and those expressing some confidence in federal workers also fell 2 points, from 55 to 53 points. Respondents expressing very little confidence in civilian federal workers increased 4 points, from 22 to 26 percent.

Going forward, however, concerns about public sector unions could possibly prevent union approval ratings from returning to their prerecession levels. Many governments are now facing budget shortfalls that can only be dealt with by drastically cutting back critical services and potentially increasing taxes, and the debate over the causes of the budget deficits and what to do about them is a top tier issue that could move public opinion.

The public’s favorable view of public employee unions could indeed change, especially since some conservatives are attempting to blame deficits on the compensation packages unionized public employees receive. Some evidence suggests opinions are already shifting for some populations.

Public opinion is more negative in states where public employee unions are at the center of budget deficit debates. Recent polls indicate that a majority of respondents in these states believe public sector unions are a significant strain on the state budget.

Sixty-eight percent of likely voters in California believe public employee unions place a significant strain on the state’s struggling budget, according to a March 2010 Rasmussen Reports survey. Just over half of voters in the state (55 percent) oppose unions for public employees, while 45 percent are in favor of them.

And an April 2010 Rasmussen survey of voters in New Jersey found that after a fight between Governor Chris Christie and the teachers’ union over whether to freeze teacher pay, 65 percent thought public employee unions like the New Jersey Education Association put a significant strain on the state’s budget, while 35 percent disagree.

Debates about public sector unions’ impacts on deficits in other states could potentially have similar effects.

Steps organized labor should take to repair its public image are outside the scope of this brief, but Americans’ reaction to the auto bailout and deficit debate suggests that the public is willing to support unions as a voice for workers as long as unionized workers’ interests don’t compete with the public’s interests. In this case, Americans see unions supporting government assistance for automakers and generous compensation packages for their members as competing with their interest by giving special treatment to some workers and adding to government debt.

This may suggest that unions should emphasize efforts that help workers get fair treatment—but not special treatment, publicize campaigns that check corporate power, and support initiatives that are seen as promoting the public interest.

Conclusion

The sudden decline in Americans’ support for labor unions may appear to be a body blow to the labor movement. But labor unions’ declining approval ratings have little to do with Americans’ support for the protections that unions afford and, for the most part, should prove temporary.

The public is angry about the weak economy and is blaming major economic institutions such as business, government, and organized labor. Also, despite the drop in overall approval the public continues to value many of the functions that unions perform—such as helping workers. As a result, support for unions should improve when the economy gets back on track.

Still, the possibility that labor unions’ public image has suffered lasting damage can’t be completely ruled out. The highly unpopular auto bailout and government budget deficits may have longer lasting effects. Unions may need to work on their public image in order for approval ratings to return to pre-recession levels.

Download this memo (pdf)

David Madland is the Director of the American Worker Project at the Center for American Progress Action Fund and Karla Walter is a Senior Policy Analyst with the project.

Obama and the Government Employees

By Ed Lasky, American ThinkerFebruary 12, 2010

Barack Obama may not have learned much at Harvard regarding the Constitution, but he did learn in Chicago how politics works: the Chicago way. Reward supporters, and keep the bribery as opaque as possible. Chicago mores have been brought to Washington.

There has recently been a flurry of critical columns examining the devastation done to our nation's fiscal health by government workers. Our cities, states, and federal government are in critical condition. Cities have begun declaring bankruptcy, and states such as California and Illinois are tottering. The federal government, which supplied a big chunk of stimulus dollars merely to keep states on life support, is running massive deficits and accumulating debts as far as the eye can see. What caused the problems?

Obama and the Democrats have been well-rewarded for their patronage. Unions contributed up to 400 million dollars to Democrats in 2008 and engage in skullduggery to advance their aims. The latest revelation: a union-funded slush fund secretly targeting GOP candidates through the use of money-laundering and front groups. Unions have funded all sorts of political activity -- undoubtedly the major reason Obama, in one of his first acts as president, ended union disclosure rules requiring them to report how their members' dues were being spent. So much for transparency.Public-sector unionism is a very different animal from private-sector unionism. It is not adversarial but collusive. Public-sector unions strive to elect their management, which in turn can extract money from taxpayers to increase wages and benefits -- and can promise pensions that future taxpayers will have to fund.The results are plain to see. States such as New York, New Jersey and California, where public-sector unions are strong, now face enormous budget deficits and pension liabilities. In such states, the public sector has become a parasite sucking the life out of the private-sector economy.

For most Americans, the Great Recession has been an occasion to hold on for dear life. For public employees, it's been an occasion to let the good times roll.

The percentage of federal civil servants making more than $100,000 a year jumped from 14 percent to 19 percent during the first year and a half of the recession, according to USA Today. At the beginning of the downturn, the Transportation Department had one person making $170,000 or more a year; now it has 1,690 making that.The New York Times reports that state and local governments have added a net 110,000 jobs since the beginning of the recession, while the private sector has lost 6.9 million. The gap between total compensation of public and private workers has only widened during the downturn, according to USA Today. In 2008, benefits for public employees grew at a rate three times that of private employees.

Federal workers now earn, in wages and benefits, about twice what their private sector equivalents get paid. They often have Cadillac health plans and retirement benefits far above the private sector average: 80 percent of public-sector workers have pension benefits, only 50 percent in the private sector. Many can retire at age 50.

Berry made noises about tying pay to performance (consider this chaff to deflect observation and criticism), but then he tipped his hand:Berry mused about eliminating the first two ranks of the 15-grade GS system and adding grades 16 and 17. Berry did not explicitly advocate a pay raise for federal workers during the interview, but those in the added grades presumably would be paid more than the current top rate.

Does that sound like a plan to increase efficiency of government workers? Give them higher pay, but allow them to set their own hours and work from...where? Starbucks? Home? The zoo?"I'm a strong proponent of breaking the chain to the desk and breaking the chain to the time clock," he said. He wants government to "move in a direction to empower and trust our employees to get the job done ... and not focus so much on where they're sitting and what hours they're sitting there."

Majority of Union Members Now Work for the Government

January 22, 2010

New data from the Bureau of Labor Statistics (BLS) show that a majority of American union members now work for the government. The pattern of unions adding members in government while losing members in the private sector accelerated during the recession. The typical union member now works in the Post Office, not on the assembly line.

Representing government employees has changed the union movement's priorities: Unions now campaign for higher taxes on Americans to fund more government spending. Congress should resist government employee unions' self-interested calls to raise taxes on workers in the private sector.

Overall Union Membership Down Slightly

The BLS's annual report on union membership shows the labor movement's decline in membership continued in 2009. While a full 23.0 percent of Americans belonged to labor unions in 1980, by 2008 only 12.4 percent did. In 2009, that figure dropped slightly to 12.3 percent. There are now 15.3 million union members in the United States, 770,000 fewer than in 2008.

This decrease in union membership is hardly news: Since the beginning of the current recession, 6 million workers have lost their jobs. Union membership unsurprisingly fell as employment shrank.

Most Union Members Now in Government

What is newsworthy, however, is another figure reported by the BLS: 52 percent of all union members work for the federal or state and local governments, a sharp increase from the 49 percent in 2008. A majority of American union members are now employed by the government; three times more union members now work in the Post Office than in the auto industry.

While the fact that the majority of union members are government employees is historic, the growth of government employee unions is hardly a recent development. Union membership has steadily grown in government and shrunk in the private sector since the 1970s.

Why Government Unions Have Grown

In 2009, government employees came to constitute the majority of union members for two reasons. First, union membership rates fell in the private sector. Unionized companies do poorly in the marketplace and lose jobs relative to their nonunion competitors. Toyota and Honda have gained jobs as General Motors and Chrysler have lost them. Thousands of repetitions of this dynamic caused private-sector union membership to fall from 20.1 percent to 7.6 percent between 1980 and 2008. In 2009, private-sector union membership fell further to 7.2 percent. Competition undermines unions.

Government employees, however, face no competition as the government never goes out of business. As a result, government employees organize at far higher rates. A full 37.4 percent of government employees belonged to unions in 2009, up 0.6 percentage points from 2008.

Second, the private sector lost millions of jobs during the recession while government employment increased slightly. Union membership moved with the jobs. Private-sector unions lost 834,000 members in 2009 while public-sector unions actually gained 64,000 members. Both of these factors combined to make government employees a majority of the union movement.

Transformation of the Labor Movement

This shift has transformed the labor movement. Some historians argue that unions were created to prevent profit-minded employers from exploiting workers and to win workers a share of business profits. However, neither of these purposes makes sense in government. As former AFL-CIO President George Meany wrote, "It is impossible to bargain collectively with the government."

Collective bargaining gives government employees the power to tell voters how to spend their tax dollars instead of the other way around. That is why early labor leaders rejected it as undemocratic. As recently as 1959 the AFL-CIO Executive Council stated that "government workers have no right [to collectively bargain] beyond the authority to petition Congress--a right available to every citizen."

Not until the 1960s did federal, state, and local governments change the law to permit government employees to collectively bargain with taxpayers. Now unions primarily represent the government--a development that has shifted the labor movement's focus from redistributing business profits to getting more from taxpayers.

Government Employees Earn More

The labor movement has, thus far, been very successful in this goal. The average worker for a state or local government earns $39.83 an hour in wages and benefits compared to $27.49 an hour in the private sector. While over 80 percent of state and local workers have pensions, just 50 percent of private-sector workers do. These differences remain after controlling for education, skills, and demographics. Taxpayers now pay for unionized government jobs paying notably more than those available in the private sector.

Government Unions Campaign for Tax Increases

Representing government employees has turned unions into determined supporters of tax increases and more government spending. Higher taxes mean the government can hire more workers and pay higher wages. As a result, public-sector unions have become a potent force lobbying for higher taxes and against spending reductions across America:

Arizona. The Arizona Education Association (AEA) successfully lobbied against a repeal of a $250 million a year statewide property tax. The AEA helpfully identified another $2.1 billion in tax increases for the legislature to pass to forestall spending reductions.

California. The Service Employees International Union (SEIU) spent $1 million on a television ad campaign pressing for higher oil, gas, and liquor taxes instead of spending reductions.

Illinois.The American Federation of State, County and Municipal Employees (AFSCME) Council 31 funded the "Fair Budget Illinois" campaign in 2009. The campaign ran television and radio ads pushing for tax increases instead of spending reductions to close the state's deficit.

Maine. Mainers rejected a ballot initiative in November 2009 that would have prevented government spending from growing faster than the combined rate of inflation and population growth and require the government to return excess revenues as tax rebates. The Maine Municipal Association, the SEIU, the Teamsters, and the Maine Education Association collectively spent hundreds of thousands of dollars to campaign against the initiative, and it ultimately lost by a wide margin.

Minnesota. AFSCME Council 5 unsuccessfully lobbied state legislators to override Governor Tim Pawlenty's veto of a $1 billion tax increase in the spring of 2009. Two Democrats joined all the Republicans in the state House to uphold the veto. In response AFSCME endorsed a primary challenger to one of the Democrats. AFSCME is now lobbying state legislators to raise taxes by $3.8 billion.

New Jersey. Democratic State Senator Stephen Sweeney, now the president of the New Jersey Senate, opposed a 1 percent increase in the state sales tax in 2006. In response, the Communication Workers of America sent giant inflatable rats and protestors in hot dog costumes reading "Sweeney the Weenie" outside the former labor leader's office. The tax increase ultimately passed.

Oregon. Public employee unions in Oregon provided 90 percent of the $4 million spent advocating two ballot initiatives to raise personal income and business taxes by $733 million.The unions want the tax increases to prevent cuts in the gold-plated medical benefits for state workers.

Washington State. The Washington state legislature has resisted calls from unions to raise taxes. In response, labor unions are threatening to withhold donations and fund primary campaigns against the Democrats who will not vote for tax hikes.

Recommendations to Congress

For the first time in American history, most union members work for the government. Competition has eroded private-sector unions while public-sector unions have thrived. Three times as many union members now work for the Post Office as in the auto industry. Unions now represent the government and have changed their priorities from getting money from businesses to getting money from taxpayers.

Congress should recognize that unions have narrowly self-interested reasons for lobbying for tax and spending increases. Congress should reject union calls for higher taxes. Government employees already earn more than private-sector workers. Congress should also reject proposals to increase union membership in the government, such as requiring the state and local governments that do not collectively bargain to do so.

Mr. Sherk is Bradley Fellow in Labor Policy in the Center for Data Analysis at The Heritage Foundation.

What Public-sector Unions Have Wrought

Former AFSCME president Jerry Wurf: "We're political as hell."

October 2010

ORGANIZED LABOR in the United States achieved a milestone in 2009 that once would have been unthinkable: for the first time, union members working in government jobs outnumbered those working in the private sector.

According to the Bureau of Labor Statistics (BLS), the number of unionized private employees fell last year to 7.4 million. That represented just 7.2 percent of the private-sector labor force, the lowest proportion in over a century. By contrast, union membership in the public sector topped 7.9 million, or 37.4 percent of all federal, state, and local government jobs. The share of government workers belonging to labor unions, in other words, is more than five times the unionized share of the private sector. Union membership in private industry peaked at 35.7 percent in 1953 and has dwindled ever since. In the public sector, unions surpassed that level years ago and show no sign of weakening.

There was a time when even pro-labor Democrats objected to public-sector unionism. "The process of collective bargaining, as usually understood, cannot be transplanted into the public service," President Franklin D. Roosevelt wrote in 1937 to the head of the National Federation of Federal Employees. In the private sector, organized employees and the employer meet across the bargaining table as (theoretical) equals. But in the public sector, said FDR, "the employer is the whole people, who speak by means of laws enacted by their representatives in Congress." Allowing public-employee unions to engage in collective bargaining would mean opening the door to the manipulation of government policy by a privileged private interest.

In the late 1950s, however, the consensus against public-sector unions began to collapse. In 1958, New York City Mayor Robert Wagner Jr. issued an order allowing public employees in the city to unionize and bargain collectively. The following year, Wisconsin became the first state to enact a public-sector collective-bargaining law. On January 17, 1962, President John F. Kennedy signed Executive Order 10988, which granted bargaining rights to federal employees. Around the country, an avalanche of public-sector bargaining laws followed. "Membership in public unions rose exponentially," writes journalist Roger Lowenstein in a recent book [1] chronicling the explosion of pension debt in American life.

Virtually proscribed only a decade earlier, by the mid-'60s these unions had been transformed into lobbying powerhouses with salaried staffs, hired lawyers, in-house newspapers, and (just in New York City alone) a quarter of a million dues-paying members.

In the ensuing half-century, the public sector in the United States has grown enormously. The number of government employees at all levels surged from about 8.2 million in 1959 to 22.5 million in 2009. Historically, government work paid less than comparable employment in the private economy, but greater job security and good pensions compensated for the lower wages. No longer: now government workers tend to fare better than private-sector workers across the board—not only in job security and pensions but in wages and other benefits as well.

Thus in New York City, for example, the Citizens Budget Commission reported in 2005 that state and local government employees were paid significantly higher wages than employees in the private sector. That differential, the commission noted, "undermines the longstanding myth that the public sector must provide unusually generous fringe benefits packages in order to compensate for higher private-sector salaries." Similarly, following an eight-month investigation, the San Francisco Civil Grand Jury observed last year:

Supporters of government pension benefit increases routinely argue that public employees are underpaid compared to private-sector counterparts, so retirement benefits must be sweetened to compensate. However, recent surveys used by the City's Department of Human Resources to benchmark compensation disclose that in nearly all job classifications the City pays more in wages and salaries than the other governmental agencies and more than most private-sector employers.

Nationwide, according to BLS data for 2009, state and local government employees were paid an average wage of $26.01 per hour, which was 34 percent higher than the average private-sector wage of $19.39 per hour. Even more lopsided was the public-sector advantage in fringe benefits, such as health and life insurance, paid vacations and sick leave, and—above all—retirement income: state and local governments provided their workers with benefits valued, on average, at $13.65 per hour, a 70 percent premium over the average benefits package in the private sector. In addition to being more expensive, the benefits that come with government jobs are provided to more employees. Life insurance, for example, was offered to 80 percent of employees working for the government but to just 59 percent of workers in the private sector. Traditional defined-benefit pension plans were available to 84 percent of government workers—but to only 21 percent of private employees.

With compensation so generous, it is not surprising that government employees are only one-third as likely to leave their jobs as workers in the private sector. The logical inference is drawn by Chris Edwards, a scholar at the Cato Institute: "[S]tate and local pay is higher than needed to attract qualified workers."

Yet when it comes to outearning Americans who labor in the private sector, state and local government employees are left in the dust by their counterparts at the federal level.

In 2008, the 1.9 million civilians employed by Uncle Sam were paid, on average, an annual salary of $79,197, according to the Commerce Department's Bureau of Economic Analysis. The average private employee earned just $49,935. The difference between them came to more than $29,000 -- a disparity that has more than doubled since 2000.

Add benefits to the mix and the federal advantage is even more striking. Total federal civilian compensation in 2008 averaged $119,982—more than twice the $59,908 in wages and benefits earned by the average private-sector employee. Edwards has tracked the inexorable widening of that gap: federal employees in 1960 averaged $1.24 for every $1 earned by an American in the private sector. By 1980, that $1.24 had grown to $1.51; in 2000 it was up to $1.66. Now it is $2—and climbing.

In its budget narrative for 2011, the Obama administration acknowledges the premium in federal compensation but attributes it to the specialized skills and greater education of federal workers:

The federal government hires lawyers to tackle corruption, security professionals to monitor our borders, doctors to care for our injured veterans, and world-class scientists to combat deadly diseases such as cancer. Because of these vital needs, the Federal Government hires a relatively highly educated workforce, resulting in higher average pay. In 2009, full-time, year-round federal civilian employees earned on average 21 percent more than workers in the private sector.

In a similar vein, when Scott Brown, the newly elected senator from Massachusetts, called in February for a federal hiring and salary freeze "because... federal employees are making twice as much as their private counterparts," he was promptly taken to task by the 150,000-member National Treasury Employees Union. "Comparing salaries of federal employees and private sector employees is not an apples-to--apples comparison," the union's president admonished Brown in a letter. "The only appropriate way to make a fair pay comparison is to compare similar jobs with one another."

A few weeks later, USA Today published just such a comparison. Analyzing the salaries (not including benefits) paid in the 216 occupations with direct equivalents in both the federal and private-sector labor markets, it found a government premium in more than eight out of 10 categories. Registered nurses in the government's employ, for example, were paid an average of $74,460 a year, while those in the private sector earned an average of $63,780. Among librarians, the federal pay advantage was $12,826; among graphic designers, $24,255; among pest-control workers, $14,995. Overall, the paper concluded, "the typical federal worker is paid 20 percent more than a private-sector worker in the same occupation."

Even when taxpayers fall on hard times, the good life goes on for public employees. During the first year and a half of the current "Great Recession," the number of federal workers with salaries of $100,000 and up increased 46 percent. At the Defense Department, the number of civilian employees making $150,000 or more quintupled from 1,868 to 10,100; at Justice, the increase was nearly sevenfold.

The devastation wrought by the worst recession in two generations has not been evenly distributed. Between January 2008 and June 2010, the American private sector lost roughly 8 million jobs. Over the same period, the public sector workforce grew by 590,000.

_____________

IT IS NOT by happenstance that the growth in public-sector union jobs—from a trivial share of overall union membership 50 years ago to a majority today—has coincided with so vast an expansion of government and of its employees' pay and perquisites. As FDR had foreseen, there are crucial differences between collective bargaining in the public and private sectors. Labor unions negotiating on behalf of government employees enjoy at least four potent advantages, which they long ago learned to exploit.

First, unlike their counterparts in the private sector, government unions are largely free from market discipline. Unions operating in the private economy know that there are limits to the demands they can make of an employer; private firms have to earn a profit to stay alive, and competition swiftly punishes those that fail to control cost and quality. If unions insist on too much, management may respond by substituting capital for labor or by closing a facility. At the bargaining table, both sides are aware that higher prices or inferior service can cause a company to lose sales, shed jobs, or even go out of business. But public-sector unions face no such constraint. The government agencies they bargain with don't have to make a profit or retain customer loyalty; they can't go out of business or relocate to another state. And, of course, their revenue is acquired the old-fashioned way: through the compulsion of taxpayers.

A second advantage lies in the difference between public- and private-sector strikes. In business, a strike (or the threat of a strike) is an economic weapon that takes a toll on both sides: management suffers the loss of business, and labor must absorb the loss of wages. Consumers may experience some inconvenience, but they generally have the option of switching to another supplier or deferring their transaction to a later date. In the public sector, by contrast, strikes are political weapons. Because government services tend to be legal monopolies, a strike by police, garbage collectors, teachers, or air-traffic controllers inflicts pain on the public at large. The union seeks to pressure management not by depriving it of revenue—the government collects taxes no matter what—but by making conditions so miserable that voters will pressure public officials to end the crisis by acceding to the union's demands.

"As the city's transit strike drags into its fourth day," the Associated Press reported last November from Philadelphia, where bus and subway operators had walked off the job, "tempers are frayed, commuter trains are packed, streets are clogged, and some residents remain virtually stranded at home." Only government unions can inflict that kind of widespread pain and chaos by calling a strike.

In many states, strikes by public employees are prohibited, and disputes that cannot be settled through collective bargaining are resolved through mandatory binding arbitration instead. Far from promoting compromise, however, binding arbitration undermines it. Unions have every incentive to bargain to impasse and then insist on arbitration, since they know that an arbitrator will almost never award public employees less than the government's final offer. That makes binding arbitration a can't-lose proposition for the unions and a certain loser for the taxpayers. As a state senator in 1969, Coleman Young authored Michigan's mandatory-arbitration law. As mayor of Detroit years later, he came to deeply regret it. "We know that compulsory arbitration has been a failure," Young told National Journal in 1981. "Slowly, inexorably, compulsory arbitration destroys sensible fiscal management" and has "caused more damage to the public service in Detroit than the strikes [it was] designed to prevent."

A third advantage: in public-sector collective bargaining, labor and management frequently both stand to benefit from higher wages and more munificent retirement income. After taxpayer activists in California last year used the Freedom of Information Act to procure a list of government retirees receiving more than $100,000 annually in pension payments, the Sacramento Bee noticed who was on it:

Managers also dominate the $100,000 club list. These are the people who are supposed to represent the public when employee benefits are negotiated. But when government managers sit down with union leaders to dicker over compensation, they are negotiating for themselves as well. If rank-and-file workers get a wage or benefit boost, non-union managers get a commensurate hike and a matching pension benefit.

Needless to say, that is not the way contract negotiations are conducted in the private sector, where managers are aware of their company's bottom line and know they will be judged on their ability to protect it. The absence of that check and balance in the public sector has often transformed collective bargaining into something closer to collusion than to hardheaded haggling.

But a fourth advantage is more significant than any of these: government labor unions can reward politicians who give them what they want and punish those who don't. As a result, negotiations in the public sector have an inherent bias toward higher salaries, more lavish benefits, and more inflexible work rules. "This is because public unions can organize politically and influence elections," Lowenstein remarks in While America Aged,

It didn't take unions long to figure out that their members' votes, and the political donations funded in part with their members' dues, would yield tremendous leverage at the bargaining table. Consequently, for many public-sector unions, politics became a core function. Time magazine, reporting in 1973 that the American Federation of State, County, and Municipal Employees was "teach[ing] local unionists how to organize political rallies, telethons, and letter-writing campaigns," quoted AFSCME's president, Jerry Wurf: "We're political as hell." That attitude is reflected on the AFSCME website, which boasts that candidates "all across the country, at every level of government" have learned to "pay attention to AFSCME's political muscle." The union is blunt about its reliance on politics to achieve its collective-bargaining aims. "We elect our bosses, so we've got to elect politicians who support us and hold those politicians accountable," AFSCME says. "Our jobs, wages, and working conditions are directly linked to politics."which is to say, they can vote their bosses out of office. This gives them direct clout over the people who determine their benefits. By contrast, the [United Auto Workers], for all its muscle, cannot vote the CEO of General Motors out of a job.

Politicians thus face huge temptations to increase benefits. Even though this is costly in the long run, in the short run officeholders are rewarded at the ballot box.

For an even blunter expression of political hardball as played by the public-sector unions, turn to YouTube and watch the video labeled "SEIU Threat." At a budget hearing in the California legislature in 2009, an official of the Service Employees International Union, the nation's fastest-growing union, was recorded telling lawmakers to give the union what it wanted—or else. "We helped get you into office, and we got a good memory," she says evenly. "Come November, if you don't back our program, we'll get you out of office."

SEIU's memory—not to mention its clout and deep pockets—was clearly appreciated by the Obama administration. SEIU spent $67 million to elect Barack Obama and other Democrats in 2008. In the first nine months following Obama's inauguration, union president Andrew Stern visited the White House 22 times—more than any other visitor. Several top SEIU officials were appointed to posts in the new administration, including Patrick Gaspard, who became the White House political director, and Craig Becker, who was named to the National Labor Relations Board. "SEIU is on the field, it's in the White House, it's in the administration," gloated Stern—with reason—in a video to his members.

Over the past two decades, AFSCME has funneled nearly $43 million to presidential and congressional candidates, making it the nation's second-largest campaign donor at the federal level. It has spent an additional $40 million on its own independent efforts to influence elections. The comparable figures for SEIU are $28 million (direct donations) and $61 million (independent activities). Other public-sector unions on the nonpartisan Center for Responsive Politics's "Top All-Time Donors List" include the National Education Association at No. 8 and the American Federation of Teachers at No. 13. Nearly all their donations have gone to Democrats, and Democrats have responded (sometimes, to be sure, with help from Republicans) by making government employment ever-more lucrative -- and by supporting the higher taxes and expanded programs that lead to even more public-sector employment.

The unions' power to "elect our bosses" has thus turned public-sector collective bargaining into a rigged game -- rigged in favor of a privileged government elite and against the private taxpayers who pay its bills.

The perks that accompany government employment have in many cases grown outlandish and unaffordable: no-deductible, no-co-pay health insurance. Preposterously lucrative overtime rules. Public-sector-only holidays. Hefty pay raises in the midst of a recession. Job security and tenure that make it close to impossible to fire even the most incompetent worker.

Looming over everything, however, are the Cadillac pension plans that most unionized government employees take for granted—and that for most other Americans are the stuff of fantasy. The heads of public-worker unions "have used their political muscle to set up two classes of citizens," says New Jersey's combative Republican governor, Chris Christie -- "those who enjoy rich public benefits and those who pay for them."

The excesses in government pensions have drawn mounting scrutiny in recent years. Every day there are a dozen or more fresh links at the invaluable website PensionTsunami.com, which aggregates the latest press coverage of the "multiple pension crises that are about to drown America's taxpayers." Even traditionally liberal, government-friendly publications -- the Boston Globe, the New York Times, the Washington Post -- have devoted considerable attention to the exploding costs of public pension plans and the many techniques state workers can use to "spike" their retirement payout.

Numerous stories have described the largesse awarded to "double-dippers" -- government employees who "retire" on a full pension and then return to government work so they can keep collecting a paycheck as well. There are even triple-dippers: in 2008, George M. Philip collected his $261,000 yearly pension as the former chief of the New York State Teachers' Retirement System, received a further $100,000 to continue consulting with the teachers fund, and made $280,000 as president of SUNY-Albany. His total one-year take: $641,000.

Other media coverage has focused on the "disability" rules that allow police and fire personnel who have been injured on the job to retire early and immediately begin receiving enhanced (and sometimes tax-free) pensions. Often these "disabilities" have nothing to do with public service. In Nevada, for instance, state law decrees that heart disease among police officers and firefighters is to be considered a work-related disability—even if it is actually due to poor diet, lack of exercise, or genes.

Loose disability rules are also an invitation to fraud. The Sacramento Bee reported a few years ago that as California Highway Patrol officers approached the end of their careers, they "routinely pursued disability claims" in order to qualify for fattened pensions—at one point, the share of CHP officers retiring as disabled was more than 80 percent—whereupon some of them "embarked on rigorous second careers." An egregious recent case in Boston was that of Albert Arroyo, a firefighter who went out on disability, claiming to have been "totally and permanently disabled" when he tripped on a staircase in March. While on injured leave, he continued to collect his full salary, tax-free. Remarkably, his "total and permanent" disability didn't keep him from competing in men's bodybuilding contests or finishing eighth in the 2008 Pro Natural American Championships.

In many states, public employees retire well before the conventional retirement age of 65. State workers in California, where public-sector unions are among the most powerful anywhere, can retire at 55 after 30 years of work, receiving pensions equal to as much as 81 percent of their last year's pay. For public-safety employees, the pension formula -- "3 percent at 50" -- is even more generous: it allows them to retire as young as 50, with a guaranteed pension equal to 3 percent of their final salary times the number of years worked. A police officer who was hired at 20 can thus retire at the age of 50 and be paid 90 percent of his final compensation each year for the rest of his life. For many retirees, this means collecting a six-figure pension for decades.

For most private-sector workers, of course, guaranteed pensions are not an option; their retirement income (Social Security aside) will come from IRAs, 401(k) plans, and other personal savings. If they contribute too little to those funds during their working years or if markets plummet, their post-retirement earnings will necessarily be reduced. But the pensions of government employees are generally set in stone. Statutes or court rulings lock states and localities into honoring their employment contracts with the unions, regardless of economic conditions or how unaffordable they may prove. That means that more and more taxpayers are going to find themselves working longer and harder, not only to provide for their own retirement, but also to pay for the risk-free, platinum-plated pensions of bureaucrats who earn higher salaries, enjoy more lavish benefits, and retire earlier than they do. Many Americans already resent the unfairness of this arrangement, and it doesn't take a crystal ball to see the backlash that is coming.

Nor does it require a seer to grasp that a fiscal catastrophe is impending as states and municipalities struggle to cover pension promises they cannot possibly afford. In February, the Pew Center on the States warned that underfunded state retirement systems collectively face a $1 trillion funding gap, a crushing prospect made worse by the obvious fact that "every dollar spent to reduce the unfunded retirement liability cannot be used for education, public safety, and other needs."

In fact, the funding gap is likely to be much greater than $1 trillion, since Pew's projection did not take into account the market crash of 2008. California's unfunded pension debt alone amounts to $500 billion, according to a Stanford University study released in April. Nationwide, estimates the Cato Institute's Edwards, the total underfunding of public-employee pensions comes to $3.2 trillion. That is an almost incomprehensible arrears, one that cannot be made up without slashing government services or drastically raising taxes—or a combination of both.

"For a glimpse of California's budgetary future," warns David Crane, California Governor Arnold Schwarzenegger's economic adviser,

look no further than the $5.5 billion diverted this year from higher education, transit, parks, and other programs in order to pay just a tiny bit toward current unfunded pension and healthcare promises. That figure is set to triple within 10 years and—absent reform—to continue to grow, crowding out funding for many programs vital to the overwhelming majority of Californians.

In July 2009, The Boston Globe interviewed Scott Lang, the mayor of New Bedford, Mass., and a rarity -- especially among Democrats -- in his willingness to call urgently for rolling back public pensions and health benefits.

He says current pension and health insurance systems for city employees have to go, period. If not, they will destroy the city and its ability to maintain the services people expect like public safety. . . .